Due to new IRS tax reporting (1099) policies, you will need to proceed with the following in your square account.

Two IMPORTANT notes:

- You may use this information in a square account that you will ONLY use for fundraising for FCA/FBC. ANY other square usage for ANY other purposes must be done in a different square account.

- You may NOT charge tax to cover the fees. To cover your fees, you should charge $10.36 and $12.42 for the boxes of candy, and all four/$41.14

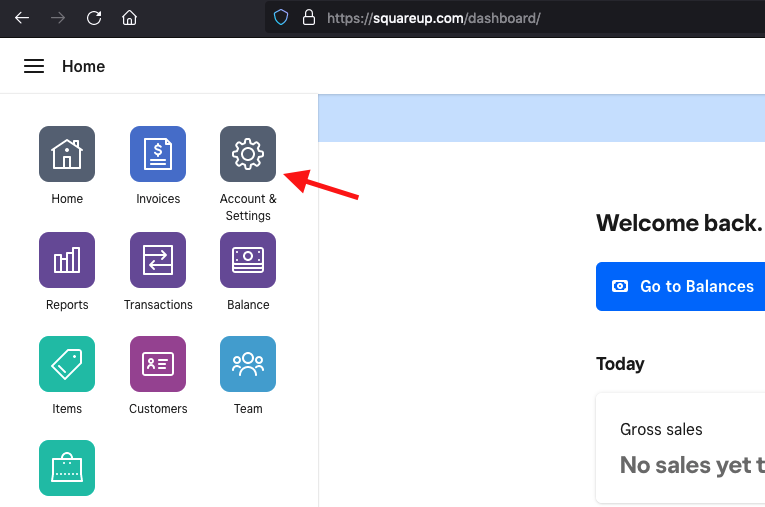

Visit squareup.com on your computer. Do NOT attempt to do this on a phone. If you need a square account, you can get one here.

Once you are logged in, click on “Account & Settings”

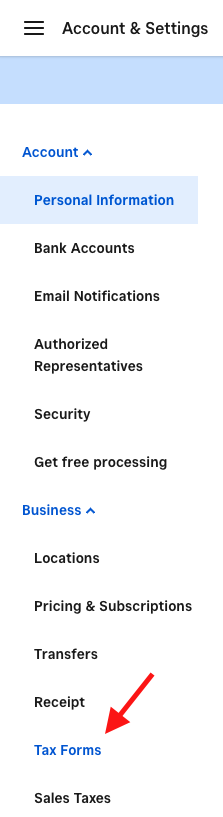

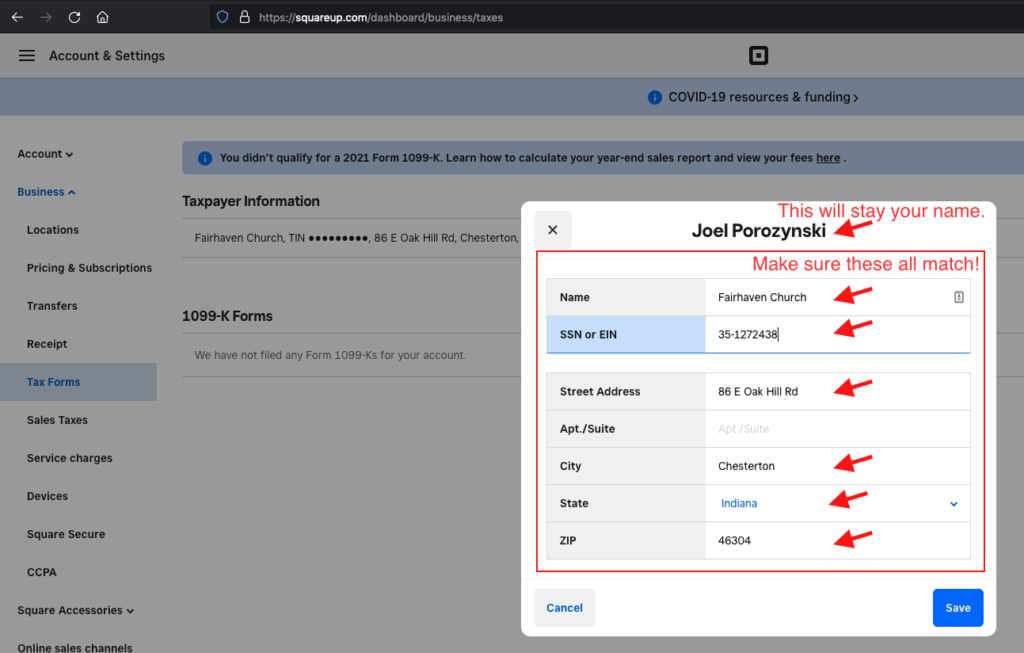

Once in the Account menu, expand “Business” and click on “Tax Forms.”

Edit your Taxpayer Information. Make sure to type the Name, number, and address exactly as below.

The EIN is 35-1272438

* After years of selling with Square, I’ve never had someone not understand why I would charge extra for fees. The few who have cared usually find the cash to purchase the candy.